- LIC PREMIUM POINT M M ROAD PILATHARA PO. PILATHARA, DT. KANNUR 670504

- kalasaparambil@yahoo.co.in

LIC Housing Finance Limited (LICHFL) offers specialized Home Loan products tailored for Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) who wish to acquire or build property in India. These schemes are structured to overcome the logistical and financial challenges of obtaining credit while residing abroad.

LICHFL provides a stable and reliable financing option, backed by the credibility of the LIC group.

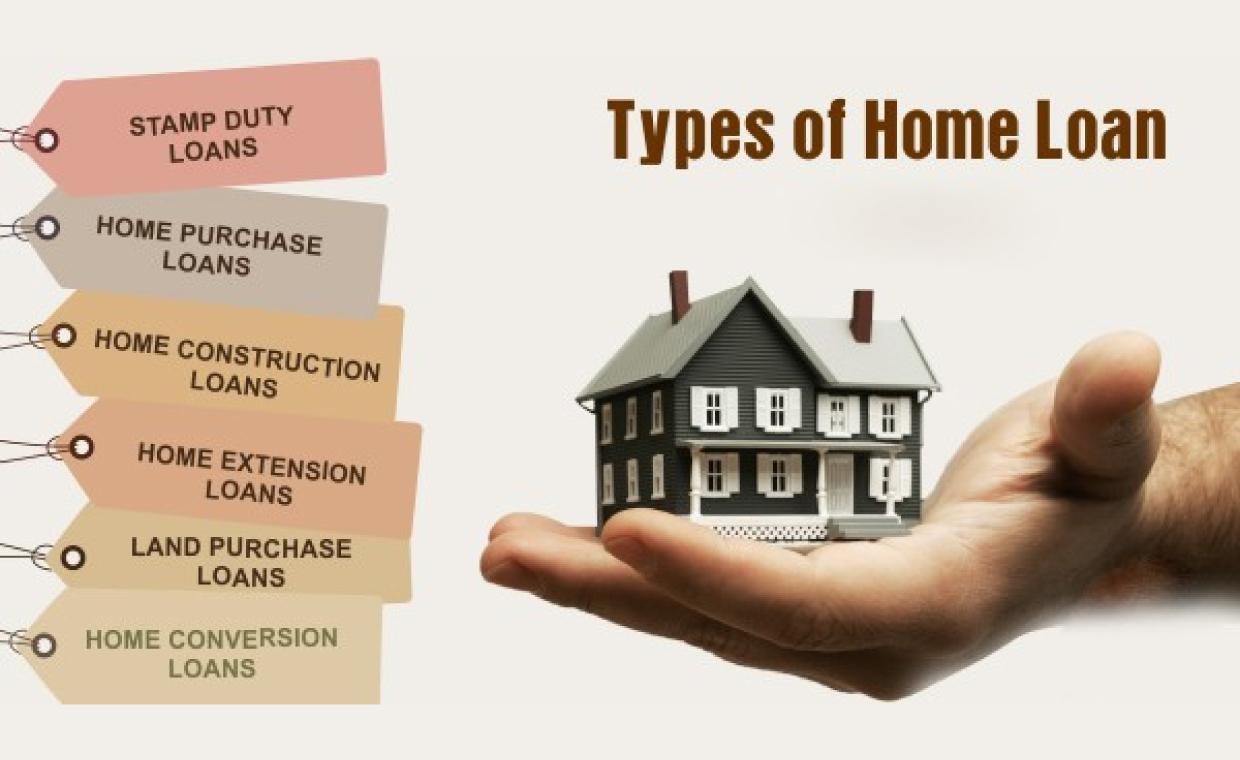

Diverse Loan Purposes: The loan can be utilized for various needs, including:

Purchase of a new or resale house/flat.

Construction of a house on an owned plot.

Renovation, Repair, or Extension of an existing home.

Plot Purchase (often a specific Plot Loan variant).

Flexible Tenure: Offers extended repayment periods, typically up to 20 to 30 years, depending on the applicant's profile (salaried or self-employed) and age.

High Financing: LICHFL may finance a significant portion of the property's value, with the Loan-to-Value (LTV) ratio often ranging from 75% to 85%, depending on the loan amount slab.

Repayment Mode: Repayments (Equated Monthly Installments or EMIs) must be made in Indian Rupees (₹) and are typically debited from an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) bank account in India via an auto-debit mandate (ECS).

Competitive Rates: Provides attractive and competitive interest rates, often linked to the company's internal lending benchmarks.

No Pre-Payment Charges: Generally, there are no penalties for full or part prepayment of the floating-rate home loan.

While specific terms may vary based on credit score and job profile, the general eligibility framework for NRI/PIO applicants is:

| Criteria | Requirement |

|---|---|

| Status | Non-Resident Indian (NRI) or Person of Indian Origin (PIO). |

| Age | Typically between 23 years (minimum) and 60–65 years (maximum at loan maturity). |

| Occupation | Salaried employees, self-employed professionals, and business owners are eligible. |

| Experience | Generally requires a minimum duration of overseas employment/business history (e.g., 2–3 years). |

| Income | A minimum income equivalent (often measured in USD or other major foreign currency) is required, demonstrating stable repayment capacity. |

| Guarantor | For certain non-professional profiles or if required by LICHFL, a local Indian resident guarantor may be mandatory. |

The application requires various documents, primarily focusing on proving NRI status, overseas income stability, and property details. Documents should often be attested by the Indian Embassy/Consulate, a Notary Public, or other authorized entities abroad.

Passport: Copy of all pages, including the latest entry/exit stamps.

Visa: Copy of the valid visa/work permit.

PIO/OCI Card: If applicable (for Persons of Indian Origin/Overseas Citizens of India).

Power of Attorney (POA): A specific, notarized POA is required in favor of a family member in India to execute legal documents on the borrower's behalf.

Bank Account Statement: NRE/NRO account statements for the last 6–12 months.

Employment Contract/Appointment Letter: Copy of the employment agreement.

Salary Slips: Latest 3–6 months' salary slips.

Bank Statements: Bank statements where the salary is credited (for the last 6–12 months).

IT Returns: Income Tax Returns filed in the country of residence (if mandatory there).

Sale Agreement/Agreement to Construct: The legal document detailing the transaction.

Title Deeds: Documents proving ownership of the property/land (if purchasing resale or constructing).

Approved Plan: Building plan sanctioned by the competent authority.

“Protecting lives and dreams with LIC’s trusted assurance.”

“Safeguarding your health with trusted coverage and care.”